Before we begin, I should tell you that the opinions I express in this voter guide are my own, and should not be attributed to my employer, my little girl, or any of the many Democratic clubs I belong to. Please send all hate mail to me at info (at) votealix.com.

So you know where I’m coming from: I’m a single mom, a liberal Democrat, an attorney and a government nerd, whose passions include arts and culture, getting more women elected to public office, and protecting our environment for future generations. I’ve worked on more political campaigns than I can count, including my own, and I also like long walks on the beach.

This ballot is surprisingly short for a Gubernatorial election, with only seven statewide measures. (I think I still have PTSD from 2016’s ballot, which clocked in at 18 measures. Writing that voter guide nearly killed me). What this ballot lacks in length, however, it makes up for in complexity – several of these measures require a graduate degree and a few hours of free time to study and understand them. That’s where I come in – I research the hell out of these measures so that you don’t have to! My aim is to provide you with way more information than you ever thought you would need to make an informed decision.

This year I have decided not to analyze the statewide candidate races. Every race is a Republican running against a Democrat, and I shouldn’t need to tell you how to vote in those races. But I’ll make it easy for you:

Governor: Gavin Newsom (D)

Lieutenant Governor: Eleni Kounalakis (D)

Secretary of State: Shirley Weber (D)

Controller: Malia Cohen (D)

Treasurer: Fiona Ma (D)

Attorney General: Rob Bonta (D)

Insurance Commissioner: Ricardo Lara (D)

State Superintendent of Public Instruction: Tony Thurmond

Board of Equalization, District 2: Sally Lieber

Here are my thoughts on the 2022 statewide ballot measures. First a summary, followed by the more detailed analysis.

Prop 1 – State constitutional right to reproductive freedom – HELL YES

Prop 26 – Legalizes sports betting at American Indian casinos and racetracks – NO

Prop 27 – Legalizes mobile sports betting and dedicates revenue to homelessness– NO

Prop 28 – Requires funding for K-12 art and music education – YES!

Prop 29 – Yet another dialysis measure – HELL NO

Prop 30 – Tax on Income Above $2M for Electric Vehicles and Wildfire Prevention – HELL YES!

Prop 31 – Upholds the ban on flavored tobacco sales – YES!

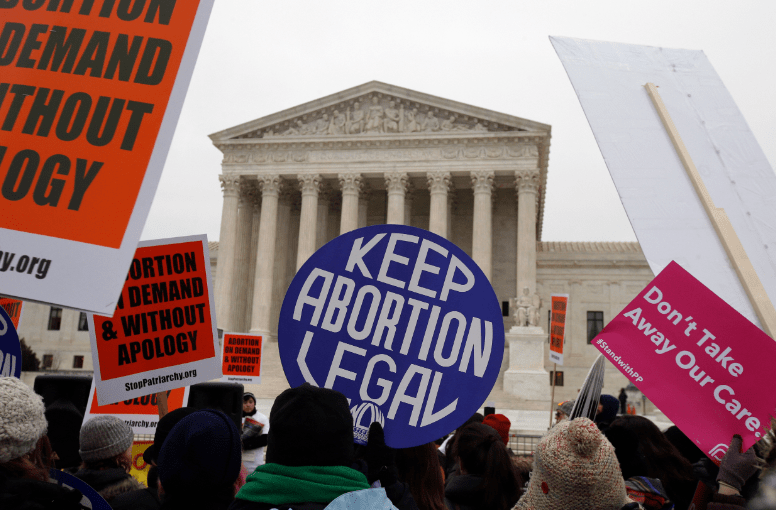

Prop 1 – Provides a state constitutional right to reproductive freedom, including the right to an abortion – HELL YES

I’ll make this one easy for you: if you support reproductive rights, vote yes on this constitutional amendment to enshrine “an individual’s reproductive freedom in their most intimate decisions, which includes their fundamental right to choose to have an abortion and their fundamental right to choose or refuse contraceptives.” If you oppose abortion and contraceptives, you will vote no.

“But wait,” you ask, “aren’t abortion and contraception already legal in California?” The answer is yes. Prop 1 doesn’t change reproductive rights law in California, per se, because contraception and abortion are both fully legal here, with abortion being legal up to fetal viability and after viability only if an abortion is necessary to protect the life or health of the mother. These rights are protected by the privacy provision of the California Constitution, which has been repeatedly used by the California Supreme Court to strike down numerous attempts at abortion restrictions, as well as the Reproductive Privacy Act of 2002, approved by the California State Legislature and signed by then-Governor Gray Davis.

But if the recent Dobbs decision by the US Supreme Court (striking down Roe v Wade) has a lesson for us, it’s that longstanding precedent can be reversed at any time. And legislatures can change the law whenever they feel like it. This is why the proponents of Proposition 1 put this constitutional amendment on the ballot – because the constitution is much, much harder to amend, and they wanted to lock that shit down.

Supporters include the California Democratic Party, Governor Gavin Newsom, US Senators Feinstein and Padilla, Planned Parenthood Affiliates of California, American College of Obstetricians and Gynecologists, and the California Medical Association, California Nurses Association, California Teachers Association, ACLU, and the Human Rights Campaign.

In his endorsement, Newsom said, “California will not sit on the sidelines as unprecedented attacks on the fundamental right to choose endanger women across the country. This measure will ensure that women in our state have an inviolable right to a safe and legal abortion that is protected in our constitution.”

My cynical political mind suspects that the measure is also about pulling Democratic women out to vote in the Gubernatorial election for Newsom, whose Kennedy-esque looks and feminist spouse make him popular with liberal moms. Polls show that support for reproductive rights are strongest in the Bay Area, which also happens to be Newsom’s base. Coincidence? Perhaps. Then again, Governor Newsom’s opponent is a Republican State Senator that no one has ever heard of, so maybe he doesn’t need the extra votes? But I digress.

Opponents of Prop 1 include the Republican Party of California, which is kind of surprising to me since the state GOP can’t afford to lose more suburban moms from its base, and opposing Prop 1 will continue to marginalize the party in this state.

Naturally, lots of Catholic organizations also oppose the measure, including the California Conference of Catholic Bishops, Democrats for Life of America, and the Knights of Columbus. In his endorsement, Roman Catholic Bishop Jaime Soto said, “The state’s political leadership continues to stubbornly cling to the practice of abortion and the throw-away culture. It is reprehensible to enshrine in the State Constitution the practice of abortion even until moments before delivery. The language of SCA 10 is overly vague, reckless and could further endanger children, especially among the poor and marginalized in our state.”

The Republican Party also argues that the amendment’s language is too broad, and will therefore allow all abortions late into pregnancy, overriding current laws that restrict post-viability procedures. This is baseless fear-mongering; there is nothing in Prop 1 that will change the current law’s viability restrictions.

Anyhoo, Prop 1 is likely to win by an overwhelming margin, since Democrats dominate California politics, and the polls are looking good. And you can follow the money: the committee sponsoring the campaign has raised over $9.3 million, and the opposition has raised less than $100k. A huge imbalance in campaign spending doesn’t always predict the outcome, but it is a strong indicator of a measure’s relative support.

Prop 26 – Legalizes sports betting at American Indian gaming casinos and licensed racetracks in California – NO

Prop 27 – Legalizes mobile sports betting and dedicates revenue to the California Solutions to Homelessness and Mental Health Support Account and the Tribal Economic Development Account – NO

I’m going to analyze Prop 26 and 27 together since they are intertwined. Before I tell you what the measures would do, I’ll share a bit of the history.

If you want to gamble in California, you are pretty much limited to 84 card rooms, 33 horse racing facilities, 23,000 stores selling lottery tickets, and the 66 Native American casinos on tribal land. Sports gambling is not legal here.

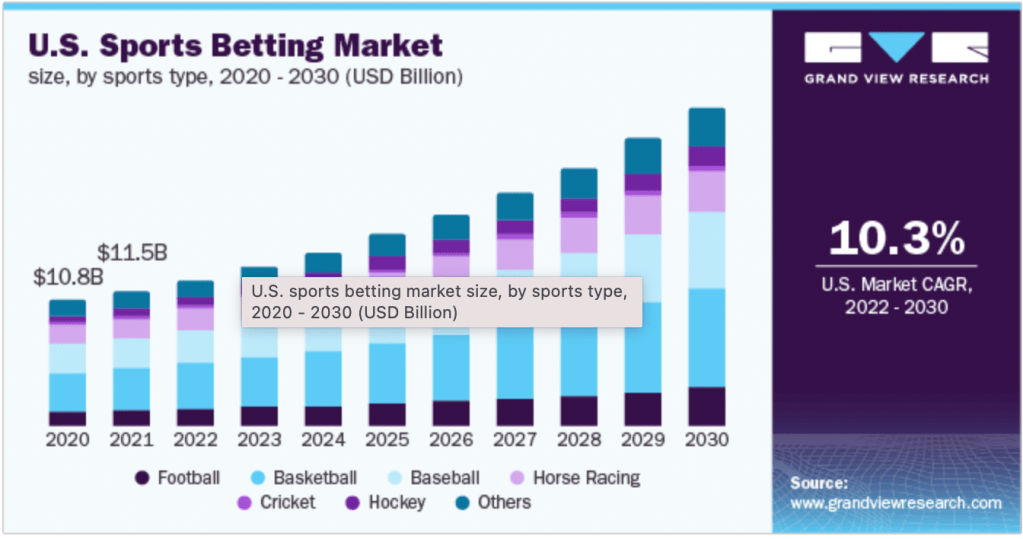

Enter Draft Kings and other online sports betting companies, who are working to break into the state. Online and mobile gaming has become a multi-billion dollar business across the U.S. in recent years, particularly during the pandemic. To give you a sense of just how big these guys are… Draft Kings went public in 2020 and its valuation in 2021 was over $20 billion. The global sports betting market size was valued at $76.75 billion in 2021 and is expected to grow by 10.2% every year from 2022 to 2030.

California is a huge untapped market for these companies, so they designed a measure in California that would allow them to operate here. Prop 27 would legalize sports gambling for adults 21 and older, and would establish regulations for the mobile sports betting industry. As a sweetener, it would also impose a 10% tax on sports betting revenues and licensing fees, and allocate the revenue to an account for homelessness programs (85%) and an account for tribes that don’t operate sports betting (15%). According the state’s nonpartisan Legislative Analyst’s Office, that sweetener could generate “possibly in the hundreds of millions of dollars but likely not more than $500 million annually” in state revenue.

But allowing sport wagering in California will jeopardize the financial future of the state’s Native American tribes, whose casinos generate $23.2 billion in economic activity every year. The companies tried to cut a deal with the casino-owning tribes, but they couldn’t reach agreement. So the tribes wrote their own measure (Prop 26) that would allow sports betting and other kinds of gambling only at casinos and licensed racetracks in California, further marginalizing the online betting companies. Ha. Game on!

In addition to sports betting, Prop 26 would allow casinos to expand into roulette and dice games. The measure defines “sports betting” as wagering on professional, college, or amateur sport and athletic events, with the exception of high school sports and events featuring a California college team. Like Prop 27, it would limit sports betting to adults 21 and over, and it would impose a 10% tax on profits derived from sports betting at racetracks (but not casinos). The revenues would be distributed to gambling prevention and mental health treatment (15%); enforcement of sports wagering laws (15%); and the rest to the state’s General Fund.

TBH, I am not a gambler or a fan of professional sports, so I’m ambivalent about whether California should allow online gambling. Should Californians be able to participate in sports wagering, as a matter of public policy? I could go either way. Do we need to spend more money on solving homelessness? Heck yeah!

Oh. Except that Prop 27 would generate no more than $500 million annually, according to the Legislative Analyst’s Office. And the state already spends three to four billion dollars on homelessness every year – will another half a billion solve the problem? I’m not convinced.

I was surprised to learn that Major League Baseball supports Prop 27. They say, “As legalized sports betting continues to expand across the country, Major League Baseball remains committed to protecting the integrity of its games and creating a safe experience for fans who wish to wager on those games. Proposition 27… includes strong integrity provisions designed to help MLB carry out those commitments.” I think they are saying, much like illegal drug use, sports betting is happening anyway, so let’s get it out in the open and tax the hell out of it.

Opponents of Prop 27 include the California Teachers Association, a smattering of Democratic and Republican elected officials, the League of California Cities, and both the Democratic and Republican Parties of California, who never agree on anything. They cite the need to protect tribal sovereignty, as well as the fear that legalizing sports wagering would send 90% of profits from sports gambling out-of-state or even out of country.

And of course, there’s the argument that unprecedented access to sports wagering would lead to more problem gambling, addiction and crime. The San Jose Mercury News opposes Prop 27 and argues that “turning every cell phone into a 24/7, portable casino” would increase the rate of gambling addiction across the state, just as it has in New Jersey, Pennsylvania and Connecticut after each of those states legalized sports wagers.

Gambling addiction, they say, leads to financial ruin, broken families, increased crime, mental health issues and homelessness. That’s right, homelessness.

For me, it really comes down to what Prop 27 will do to the existing Indian casinos. Native Americans remain the most impoverished and underprivileged minority community in the nation, and I’m sure I don’t need to tell you why. (But I will anyway…) Early white Americans forced them onto land that they couldn’t mine or farm, and left them with nothing after obliterating their communities by way of violence and disease. (But how do you really feel, Alix?). The 19th century federal government acknowledged their tribal sovereignty, which later enabled some tribes to establish gaming casinos to support their communities. But the casinos have had inconsistent results: while some tribes (near urban areas) are doing relatively well, rural casinos don’t generate as much revenue. Here’s a good history of tribal casinos if you’re interested.

Anyhoo, U.S. census data consistently indicate that the legalization of Indian gaming has not improved the lot of the indigenous population in the aggregate, and many tribes continue to languish in poverty. Allowing sports betting to become legal in California would certainly undercut the casino-owning tribes’ self-sufficiency, and threaten the billions of dollars in economic activity that tribal casinos generate every year, along with a few hundred thousand California jobs.

Both the yes on 26 and 27 campaigns have been accused of spreading misinformation. For example, check out the Yes on 27 campaign website – the header is “Yes on Prop 27 – Homelessness Funding Backed by California Tribes.” It says almost nothing about sports betting, which I find incredibly disingenuous and deceptive. They also tout the support they have from the non-casino-owning tribes who stand to benefit from their measure, without mentioning that tribes have raised tens of millions in opposition.

It is intentionally confusing. Yuck.

You may also find it interesting that Prop 27 never gained widespread support among the folks you’d think would be thrilled to have a new half billion dollars a year to play with: California’s homeless service providers and low-income housing builders.

As for Prop 26, the supporters include a few law enforcement organizations and racetrack owners in addition to the casino-owning tribes. The supporters’ main argument is that Californians should have the choice to participate in sports wagering at highly regulated, safe and experienced gaming locations. Prop 26 helps make Indian casinos more profitable, which in turn supports the tribes’ independence.

The No on Prop 26 campaign includes the Republican Party, the California Animal Welfare Association (which presumably doesn’t support making racetracks more profitable), in addition to the online sports betting companies. They argue that Prop 26 will expand the tribal casinos’ “tax-free monopoly on gaming” and “rewards those operators for prioritizing their own wealth over public health and safety.” Oh, boo hoo. The tribes are being selfish instead of sharing the bounty of gambling in California with multi-billion-dollar corporations. Poor Draft Kings! Someone call them a Wambulance.

Given how much money is at stake in these two measures, it won’t surprise you to learn it is the most expensive campaign in California history. As of September 24, the pro-27 campaign had raised over $169.2 million. Its top three donors include BetMGM LLC, Betfair Interactive US LLC (FanDuel Sportsbook), and Crown Gaming, Inc. (DraftKings). The No on 27 campaign has raised $214.6 million. The top three donors include the San Manuel Band of Mission Indians, the Pechanga Band of Luiseno Indians, and the Yocha Dehe Wintun Nation. The Yes on 26 campaign is supported by several American Indian tribes, and has raised more than $73.08 million. The online gambling companies have raised more than $42 million to oppose the measure.

All of the newspapers oppose both measures: LA Times, SF Chronicle, San Jose Mercury News, Sacramento Bee, and I agree. Vote no.

Prop 28 – Requires funding for K-12 art and music education – YES!

Prop 28 is very simple – it secures funding for arts and music education in California schools, without raising taxes.

In 1998, California voters approved Prop 98, which required at a minimum, roughly 40% of California’s budget to go to schools and community colleges each year. Prop 28 would mandate that at least 1% of the total Prop 98 funds be spent on arts and music education. It also makes sure that more funding is allocated to schools with a high percentage of students from low-income households, rather than wealthy schools. Finally, it requires schools with 500 or more students to spend 80% of the money on employing teachers, with 20% going to training and materials. The nonpartisan Legislative Analyst’s Office puts the number at around $1 billion annually! That’s a lot of arts teachers.

I won’t waste much of your time on Prop 28, because there is no organized opposition and Prop 28 is likely to pass. Proponents have raised more than $9.3 million in support of the campaign, and endorsers include former U.S. Secretary of Education Arne Duncan, the California Teachers Association, lots of elected school board members across the state.

Numerous celebrities and musicians back the measure, including Dr. Dre, Goldie Hawn, Jason Momoa, Katy Perry, Lenny Kravitz, Will.I.Am, John Lithgow, Christina Aguilera, Issa Rae, and even Weird Al Yankovich.

Even though there isn’t organized opposition, there is at least one good government argument against Prop 28, which is that budgeting by the ballot box is a bad idea. While arts and music education is an extremely noble cause, I generally don’t like it when voters are asked to earmark specific programs. Once a measure is approved by the voters, it is extremely hard to change or repeal. Prop 28 will be forever tying the hands of the legislature, of the Governor, and of the very schools this measure is intended to help. Measures like Prop 28 are all well and good in a year like 2022 when there is a budget surplus, and we have an extra BILLION dollars to throw around, but the next time the economy takes a downturn, Prop 98 funds are going to be much tighter and will force the schools to make some hard decisions.

As the San Jose Mercury News noted, “It’s fiscally reckless to keep earmarking unpredictable state general fund money when we don’t know what the future needs of California will be as it confronts, for example, a housing shortage, climate change, inadequate water supplies and wildfires.”

I am a mom and an arts enthusiast, so on balance I will support this one. Experts agree that arts education is not a luxury – it’s critical to the health of civil society, as expressed by increased civic engagement, greater social tolerance, and reductions in criminal behavior. One study in Boston showed that students and parents were more engaged in schools where art and music were a part of the curriculum — which led to lower truancy, and better test scores in some instances.

Unless you have a kid in public school, you may be surprised to learn that only 1-in-5 California schools have a full-time art or music program, according to Prop. 28 proponents. So this measure is sorely needed, particularly in schools that don’t have multi-million dollar PTA fundraisers. Rampant learning loss due to the pandemic, and the flight of students from the public school system continue to challenge our education system. Juicing up the arts and music programs in schools could get some kids and parents more engaged in schools again, and that is a good thing.

I am voting yes.

Prop 29 – Enacts staffing requirements, reporting requirements, ownership disclosure, and closing requirements for chronic dialysis clinics – HELL NO

OMG, seriously?? Prop 29 makes me mad because it is such a waste of your time. It is indeed the third time in six years that California voters have been asked to weigh in on whether dialysis clinics should be subjected to new requirements, because the union trying to organize those clinics can’t get the clinic owners to bargain with them. Voters have overwhelmingly rejected the dialysis measures in the past (See Prop 8 in 2018, which lost by 20% of the vote, and Prop 23 in 2020, which lost by a whopping 27%).

Prop 29 would require dialysis clinics to:

- Have at least one licensed physician, nurse practitioner, or physician assistant to be on site during treatment;

- Report dialysis-related infection data to state and federal governments;

- Not close or reduce services without approval from the state; and

- Not discriminate against patients based on the source of payment for care.

The only difference between this year’s measure and 2020’s Prop 23 is a change in the staffing requirement. Prop 23 would have required all clinics to keep a physician on-site during treatment hours. Prop 29 is the same, only the new measure would require either a physician, physician assistant or nurse practitioner with at least six months of experience providing care to kidney patients to be available on-site. If clinics can’t find the personnel, they can request an exemption to provide this service through telehealth.

Note that dialysis facilities are already required to employ a physician medical director and keep a registered nurse on site.Prop 29 would require that the physician, PA or RN be on site during every treatment, around the clock. California’s nonpartisan Legislative Analyst’s Office found that this measure would “increase each clinic’s costs by several hundred thousand dollars annually on average.” You don’t need to be a financial whiz to know that this could force clinics to close, particularly in rural regions, putting patients at risk.

Here is what I wrote in 2020:

I can’t believe it, ANOTHER KIDNEY DIALYSIS BALLOT MEASURE?! You may remember Prop 8 from 2018, which asked voters to limit the profits of kidney dialysis clinics. I went “no” on that one because I didn’t think it was the kind of law that should be decided by the voters. And it was clearly a revenge play by SEIU-UHW West, the labor union that was in a fight with the state’s two largest dialysis businesses DaVita and Fresenius Medical Care. I feel that same way about Prop 23.

Here we are again. Same story, different day. …

SEIU-West has been trying to organize the kidney dialysis clinics for years, and they claim that the big greedy dialysis clinic owners aren’t doing right by their patients or staff and they want better staff-to-patient ratios. The union put Prop 23 on the ballot because they tried getting a law passed in the legislature, but they couldn’t get the votes.

As to the doctor requirement, they argue that dialysis is a dangerous procedure, and if something goes wrong, a doctor or highly trained nurse should be nearby. As for the reporting requirement, they say that they want problems to be identified and solved to protect patients, implying that the clinics aren’t meeting patient needs. Finally, they say that the clinics are critical to patient survival so they shouldn’t be allowed to close or reduce their services, even if this measure makes their costs go up.

…[Opponents] argue that Prop 23 jeopardizes access to care by imposing unnecessary bureaucratic mandates, making it harder for the clinics to do their jobs well. They worry that Prop 23 would increase state healthcare costs by an estimated $320 million annually, and force some clinics to close, pushing patients into emergency rooms for treatment.

For the on-site physician requirement, [opponents] argue that every dialysis patient is already under the care of their personal kidney physician and dialysis treatments are administered by specially trained and experienced dialysis nurses and technicians. Prop 23 would make the state’s physician shortage worse by taking physicians away from other hospitals and clinics where they are more needed.

Prop 23’s restrictions on clinics are a bit triggering for me. For most of my career, I’ve been closely watching all the restrictions religious conservatives have succeeded in placing on abortion clinics around the country, and the rules proposed in Prop 23 are eerily familiar. The abortion clinic rules have never been about quality of care, they have always been about making it harder for the clinics to keep their doors open. I suspect the same is true here. Why else would a non-healthcare related labor union put a measure on the ballot with healthcare-related implications? Seems very fishy. ESPECIALLY since the healthcare advocacy organizations (see: California Nurses Association, California Medical Association) oppose the bill.

I’ll conclude by quoting my 2018 analysis of Prop 8, because the same reasoning applies here:

“As you know, a ballot measure can only be amended or repealed by another ballot measure, and that’s no way to govern a state. Super detailed, highly technical laws should NEVER be passed by ballot measure because they usually need adjusting over time, and that can’t happen if they are approved by voters. Moreover, if this measure passes, and dialysis clinics start going out of business, it jeopardizes access to care for patients in California who need dialysis treatments to stay alive. SEIU should make its case in court, or with the legislature, or the National Labor Relations Board, anywhere but the ballot box.”

It’s notable that many public health and patient advocates oppose Prop 29, including California Nurses Association, California Medical Association, Minority Health Institute, Renal Healthcare Association, Chronic Disease Coalition, and many others. Likewise, all the newspapers have come down against it, including the SF Chronicle, LA Times, Sacramento Bee, Santa Cruz Sentinel, and San Jose Mercury News.

Over 80,000 Californians receive dialysis for kidney diseases. For these patients, missing even one dialysis appointment can be life-threatening. This cynical effort by SEIU to bring the clinics to the bargaining table is playing a dangerous game with these patients’ lives. I am a strong NO on this one.

Prop 30 – Tax on Income Above $2 Million for Zero-Emissions Vehicles and Wildfire Prevention Initiative – HELL YES! – I have posted my analysis separately here

Prop 31 – Upholds the ban on flavored tobacco sales – YES!

In August 2020, Governor Newsom signed into law a ban on the sale of flavored tobacco products. Senate Bill (SB) 793 bans menthol cigarettes, flavored e-cigarette products, and flavored oral tobacco products. Retailers can be fined $250 for each illegal sale, and exceptions were made for hookah, premium cigars, and pipe tobacco.

Even though it was signed two years ago, SB 793 has never gone into effect. The big tobacco companies bought themselves some time by filing Prop 31, which delayed the enforcement of the law until after the voters could weigh in. A YES vote on Prop 31 would approve of SB 793’s ban on flavored tobacco, and a NO vote would overturn the law.

If Prop 31 passes, California would become the second state in the U.S. to enact such a ban after Massachusetts. A number of cities, including Los Angeles and San Diego, have already enacted their own bans.

When you’re deciding how to vote on a measure, sometimes all you need to do is look at who is lined up on both sides. In the case of Prop 31, supporters include liberal politicians and advocates for children and public health: California Gov. Gavin Newsom, Democratic Party, Campaign for Tobacco-Free Kids, American Cancer Society Action Network, Kaiser Foundation Health Plan, American Heart Association, the American Lung Association, and the California Teachers’ Association.

Opponents include big tobacco companies (R.J. Reynolds Tobacco Co. and Philip Morris USA), small business advocates who worry about the loss of revenue from cigarette sales, and the folks who hate taxes and regulation, including the Howard Jarvis Taxpayers Association, and the Republican Party of California. Which side do your values align with?

Supporters of Prop 31 argue that flavored tobacco products are intended to hook kids on tobacco, and they are especially dangerous amid the COVID pandemic when youth deaths spiked from respiratory complications. They acknowledge it’s already illegal to sell tobacco products to anyone under 21, but they say flavored cigarettes and vaping cartridges are still too easy for teens to obtain.

They note that menthol cigarettes disproportionately impact minority communities, observing that around 85 percent of Black smokers use a menthol cigarette, with the tobacco industry gearing its marketing of menthol cigarettes toward Black Americans. They also allege that menthol acts as a cooling agent, masking the harsh taste of tobacco, which allows new smokers to become hooked more easily.

The tobacco industry has fired back, defending the right of Black and Latinx consumers to smoke menthols. “It’s unfair for communities of color. Bad law. Bad consequences,” said one ad paid for by R.J. Reynolds. But the ads drew a backlash from some Black leaders. Then-Assemblywoman Shirley Weber, chair of the California Legislative Black Caucus, said it was offensive for the tobacco industry to “make us believe that mentholated cigarettes are part of African American culture, and that this is a discriminatory piece of legislation against Black people.”

The tobacco giants also argue that the increase in the tobacco age to 21 in 2020 has already reduced youth access to tobacco products. While the desire to protect youth may be well-intentioned, opponents say that California is becoming a nanny state, and adults should have the right to choose whether to use these products just like with alcohol and marijuana.

Howard Jarvis and the California Republican Party wants to repeal SB 793 because they say it would cause a giant loss in tax revenue. (This is a strange argument coming from the guys who normally oppose all taxes. But these taxes are OK, I guess? Mmm hmm.)

And they are right about the loss of revenue – sorta. The independent Legislative Analyst’s Office (LAO) estimates a ban could cost the state tens of millions of dollars to around $100 million annually in tax revenue. However, the LAO continues, if a substantial number of smokers quit because of the ban, it could mean some savings to the state’s health care system. And yet, the LAO further adds, if these smokers quit and live longer, it could increase the government’s health care costs. “Given the possibility of both savings and costs, the resulting long-term net impact on government health care costs is uncertain,” the LAO concludes.

Opponents also argue that a ban on flavored e-cigarettes is problematic from a health care standpoint because e-cigarettes are safer than combustible cigarettes. And yet, the claim that vaping is a healthy alternative to smoking isn’t supported by any legitimate medical authority. In fact, there is a growing body of evidence to the contrary.

According to the Chronicle, tobacco use still kills 40,000 people each year in California and costs the state nearly $10 billion in health care. And the evidence about teens using menthol cigarettes and other flavored tobacco products is undeniable – 1 in 8 California high school students was a tobacco user as of 2019, 86.4% of whom used flavored products.

It is worth noting that Canada banned menthol cigarettes several years ago without any controversy. One study predicted, based on Canada’s experience, that if the U.S. were to ban menthols it would help over 1.3 million people quit smoking.

What pisses me off is the tobacco industry’s cynical manipulation of the political system to buy themselves some time. By delaying the implementation of SB 793, and spending $20 million to get Prop 31 on the ballot, they will make an estimated $830 million in revenue from menthol cigarette sales alone since the start of 2021. So, regardless of whether they win or lose Prop 31, they have already won. Let’s hand them a clear message that they are on the wrong side of history. Vote no.

Thanks for reading! If you found this voter guide useful, please throw a few pennies in the jar to help me cover my costs. And please forward this link to your friends and frenemies, or post it on social media. Thank you!